How Much is a Security Deposit for Electricity?

In Texas, like in much of the country, the power company requires an electricity deposit before you get electric service if you’re a new customer. This requisite protects the energy provider and other consumers from those who use electricity and then leave without paying.

You see, unlike other commodities, people consume electric power first and then pay for it later when the utility bill comes in. This carries the risk of consumers leaving the electricity provider without settling the necessary fees. The lost revenue affects other consumers, thus the need for a deposit.

But no worries. The electricity deposit is refundable, so that’s not money down the drain. There are even ways to avoid electricity deposits altogether. How does the process go, and what do you need when setting up a new electric service? Let’s discuss those details, shall we?

What is an Electricity Deposit?

An electricity deposit is a payment made upfront to a retail electricity provider (REP) to secure a connection to the power grid and guarantee a reliable supply of power. Electricity deposits can be a one-time fee, or you can pay them in monthly installments. This requirement is common, not just in Texas but throughout the country, and doesn’t imply that you have a poor credit history.

The good news is that if you have a good utility payment history, you may be able to get the deposit waived altogether. On the other hand, a bad payment history can lead to a larger electricity deposit.

Average Cost of a Power Deposit

How much an electricity deposit costs varies as several factors influence the required payment. These factors include the size of your home, your electricity provider, the type of utility service you need, and, yes, your credit history.

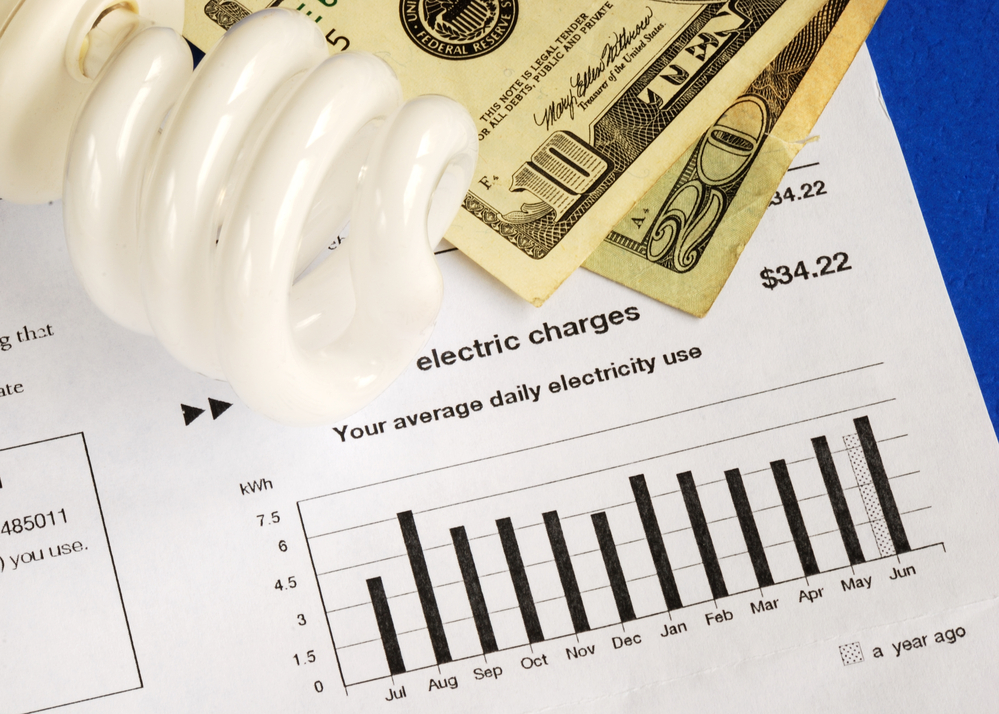

On average, electricity deposits come to about 20% of your estimated yearly power bill or the total of the estimated electricity bills for 2 consecutive months.

Common Reasons Why Energy Companies Require Energy Deposit

Being asked to put down a utility deposit doesn’t mean you have a dubious utility payment history or a low credit score. In fact, a high credit score won’t automatically exempt you from the requirement. Let’s look at why utility companies require you to pay utility deposits.

- No utility payment history: This means you have no established account associated with any utility company. As such, there’s no way of checking your payment record.

- Poor utility payment history: Missed or late payments with a utility company often prompt the power provider to require electricity deposits. Your history makes you a high-risk candidate for defaulting on your fees. On the other hand, on-time payments can mark you as a good candidate for electricity service.

- Outstanding balance: If you have an outstanding balance on your utility accounts, you’ll be required to put down a deposit to protect the company from unpaid bills and cover the risk of you ending the service without paying your bills.

- Inability to verify your identity: Almost all retail power providers review your credit score when you sign-up for electricity service to determine if you’ll need to pay a deposit upfront. Thus, they need to verify your identity. If they cannot do so, they will often request electricity deposits. The reasons why the company can’t verify your identity include a credit freeze or fraud alert with major credit card bureaus or mistyping your personal information.

Refunding Your Electric Deposit

Putting down a deposit doesn’t mean saying goodbye to your hard-earned money. Electricity deposits are refundable. The electricity company typically refunds the entire deposit after 12 consecutive months of paying your utility bills on time.

If you switch providers, you’ll still be able to get your deposit back. The amount is used to offset the final bill with your old provider, and any remaining amount will be returned to you. Expect a refund check for the difference within 45 days of the settlement of your final bill. You even get a little interest on the deposit you paid when it’s refunded.

In case you move but continue service with your current utility provider at your new home, the deposit will transfer to the new account.

Tips to Help You Avoid Energy Deposits

Most electricity providers require deposits, and we know paying this fee can be a hassle. Fortunately, there are ways to avoid electricity deposits. Here’s how you can sidestep this requirement.

- Pay your bills on time: Paying your energy bill on time and in full is one sure way of avoiding electricity deposits in the future. Set a reminder to alert you when your bills are due, so you never miss a payment. Making payments on time may not always be an option. Still, you can work with your utility provider and set up a payment plan before you receive a disconnection notice or a late fee notification. The company might allow you to pay an initial amount and settle the balance in increments over time, making payments easier on the pocket.

- Sign up for automatic payments: Having automatic payments in place ensures your bills are paid in full and on time. This keeps your account in good standing, which would look good to future utility providers you’ll work with.

- Have good credit: Having good credit goes a long way toward avoiding deposits. Utility companies often check your credit score before requiring a deposit. Having a good score increases your chance of avoiding a deposit.

- Get a prepaid energy plan: This type of plan lets you avoid deposits and credit checks. Instead, you pay for an initial amount of electricity and consume the kWhs until you reach the specified limit of your payment. Topping up the money in your account will give you a continuous electricity supply. Most power companies that offer prepaid energy plans quickly approve all customers regardless of credit score or history of payment.

FAQs

Who Offers no Deposit Electricity in Texas?

Several energy companies in Texas offer no-deposit electricity. Payless Power is one of the most well-known, as well as the biggest. Other power providers include TXU Energy, Amigo Energy, and Peso Power.

How Much is a Deposit for Electricity in Tennessee?

In Tennessee, you must put down a deposit before the service is connected. The amount depends on several factors, including your credit record. The electricity deposit for residential customers is about $240, while commercial customers need to put down $425 as an electricity deposit. The deposit for residential consumers can be waived if they provide a letter (on the utility letterhead) from their previous utility provider stating that the customer had excellent credit during the last 12 months.

Does Duke Energy ask for a Deposit?

All new residential customers must first establish credit before receiving service. Duke Energy typically runs a credit check on consumers upon application to determine if the company will require a deposit. This can be paid online, at the provider’s various payment locations, or by calling the company’s customer service number.

Do you Pay in Advance for Energy?

How you pay for energy depends on your plan type and arrangements with your energy provider. Generally, you consume energy before paying for it in the next billing cycle. That’s why most power companies require a deposit before connecting your service. However, if you opt for specific plans (such as prepaid electricity), you’ll pay for your consumption in advance.

Conclusion

Paying for something you haven’t used or consumed yet may not feel right, but you should understand the purpose of a security deposit for electricity. It protects the power provider from unexpected costs that will affect other customers in their service. By requiring a deposit, the company can ensure they have the funds to cover any unpaid balances.

The cost may be an added burden but remember that you can get a refund when you end the service. The same goes if you pay your bills on time for a specified number of months. That means you won’t be throwing your hard-earned money away.

Keep your account in good standing and maintain a good credit score to avoid deposits. You can also choose a prepaid plan that usually doesn’t require a deposit or credit check.

Updated on